In the race to develop new cancer interventions, time is money.

Sign up for our newsletter

Join our scientific community to stay up to date with Element news, insights, and product updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

.webp?width=947&height=533&name=EB_RacetoDiscover.03%20(1).webp)

The last thirty years have seen a 32% decrease in cancer death rates. The single largest driver of this success story is public health initiatives to reduce smoking, but improvements in early detection and treatment have also made significant contributions to better survival rates, particularly in breast and colon cancers. Next generation sequencing (NGS) has played a central role in these advances, first by transforming our understanding of cancer genomes, then as a critical tool for drug development and therapy selection.1 However, with cancer still the second most common cause of death worldwide, much more remains to be done.2 The desire to further improve outcomes is a driving motivation for cancer researchers, but success requires a clear-eyed view of what it takes to bring a new test or drug to market.

The Scylla and Charybdis of biopharma development

In 2021 alone, the biopharmaceutical industry invested over $200 billion in R&D, with the largest category being drug discovery and development in immune-oncology or other anticancer therapeutics.3,4 Bluntly, developing a new cancer intervention requires large financial investments and a tolerance for risk, and managing this risk often involves timelines. Every experimental delay lengthens program timelines, slows program reprioritization decisions, and increases the risk that funding will run out or that a drug or test will be too late to market to recoup investments. For biotech companies, both time and money are precious.

NGS sequencing is one area where this tension between time and money is clear. For cost efficiency, companies feel pressured to outsource sequencing to large, centralized labs to achieve low cost per base. However, this dependency on batching to achieve economies of scale introduces delays in turn-around times that slow research.

Breaking the link between scale and cost

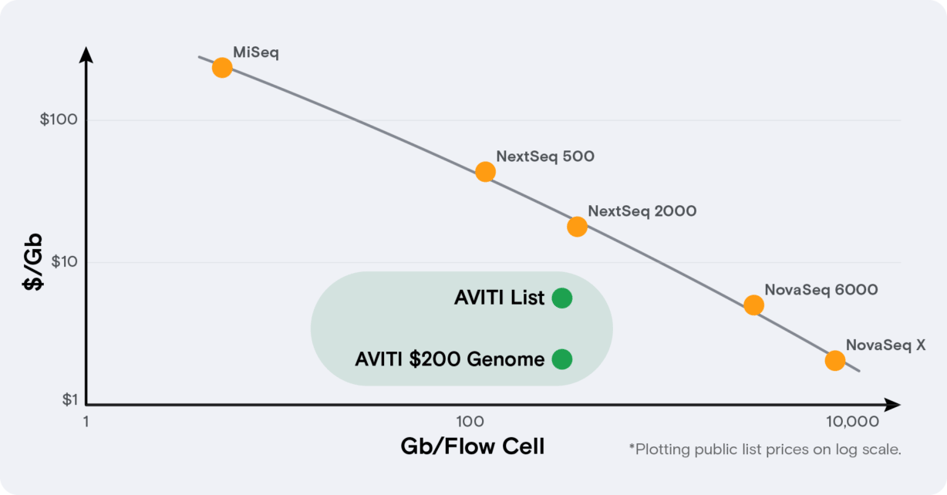

Often when confronted with an either-or choice, the solution lies in thinking outside of the box – in this case, the DNA sequencing box. The AVITI™ DNA sequencing system offers biotech companies a way to save both time and money by breaking the link between scale and cost. The AVITI System is unique as a benchtop platform that combines high quality data, low cost per base, and maximum flexibility with 2 fully independent flow cells. At $2-5 per gigabase, running costs are on par with NovaSeq outsourcing costs, minus the time inefficiencies. The forthcoming Cloudbreak chemistry, coming in May 2023, will enable 2x75 runs to be complete in less than 24 hours. Best of all, the sample prep workflow is fully compatible with standard NGS library prep ecosystem partners, meaning negligible interruption to established lab processes.

An in-house AVITI system will enable you to:

- Unlock resistance or prognostic markers of tumor evolution with somatic variant detection with up to 24 paired tumor/normal exomes per dual flow cell run.

- Uncover tumor diversity and microenvironment roles in tumor progression by running exomes/genomes on one flow cell and transcriptome profiling on a second, either simultaneously or staggered.

- Discover rare variants and novel biomarkers with deep targeted sequencing using validated solutions from Agilent, Twist, or Qiagen.

- Sequence 10X Genomics single cell libraries at improved performance over SBS sequencing on fresh, fixed or FFPE samples.

- Combine BD Rhapsody single cell library preparation, pairing cost-effective in-house sequencing with gentle handing of fragile and scarce immune cells and multianalyte detection.

Closing

In the race to score the next win again cancer, biotech companies are eager to find new ways to accelerate their research programs. If high sequencing costs or long project queues are holding back your innovation, an AVITI system can help you take control of your cancer research and development timeline.

To learn more, contact an Element scientist.

1. Mardis, E. (2019). The Impact of Next-Generation Sequencing on Cancer Genomics: From Discovery to Clinic. Cold Spring Harb Perspect Med. doi: 10.1101/cshperspect.a036269.

2. Cancer Facts and Figures, American Cancer Society, Jan 12, 2022.

3. Total global spending on pharmaceutical research and development from 2014 to 2028. Statista.

4. Leading 10 therapeutic categories worldwide by number of R&D products as of 2022. Statista.